Demand accelerated and posted 16.1 million sq ft take-up in Q2 2021, up 39% y-o-y.

Q2 2021 supply is down 26% y-o-y to stand at 25.2 million sq ft. This includes speculatively developed schemes due to come online in Q3.

Investment activity continues unabated and we expect yields to harden further over the next eight to 12-months before normalising.

Demand

- The great consumer shift has occurred and will not be reverted. The pandemic has brought forward between six and 10 years of online commerce development in just over one year as consumers have embraced online shopping. 2020 saw a record annual online commerce share of total retail sales, this share will inevitably decrease in 2021. However, consumer shopping habits have changed forever and while older generations may somewhat revert to their original shopping behaviour, younger demographics will continue to shop online more than they used to do prior to the first lockdown back in March 2020.

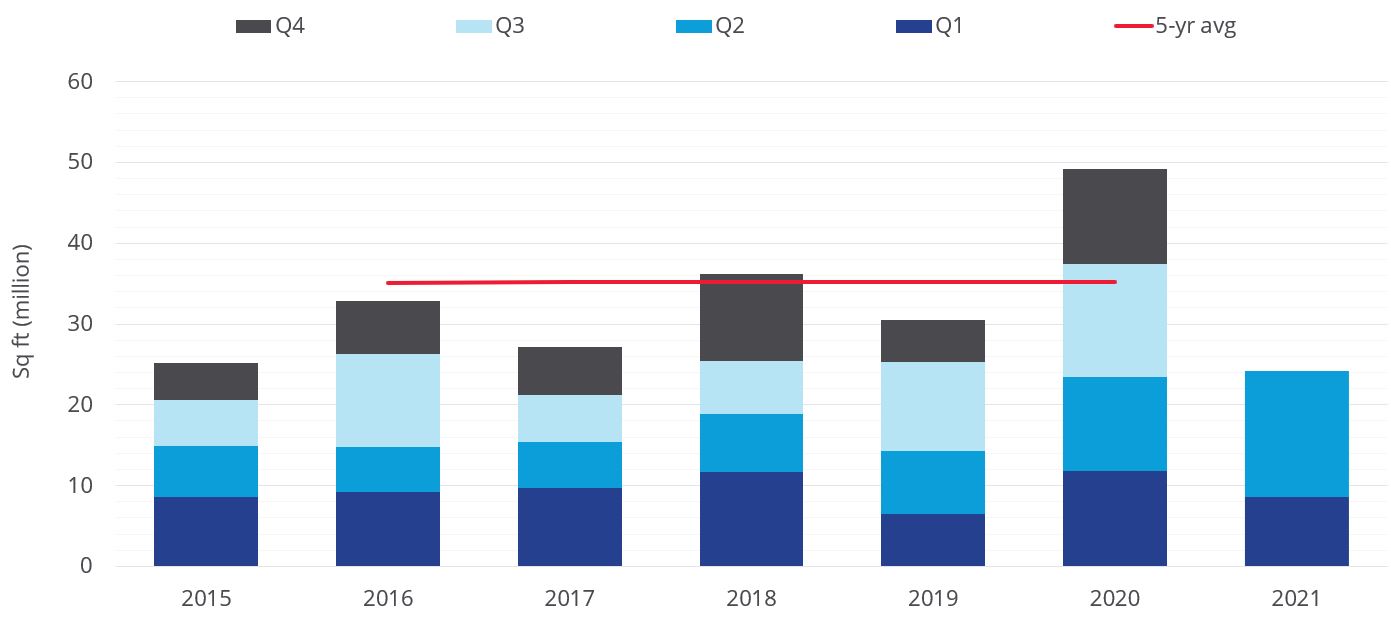

- In this respect, due to occupiers need for faster fulfilment operations, tenant demand accelerated and posted 16.1m sq ft take-up in Q2 2021. This is 39% up y/y and represents a new quarterly record for the sector. This strong demand took the total for the first six months of the year to 24.6m sq ft, marginally higher than last year’s six monthly reading. There is also quite a lot of space under offer or awaiting planning permissions and this, coupled with future expected demand, will result in a strong 2021.

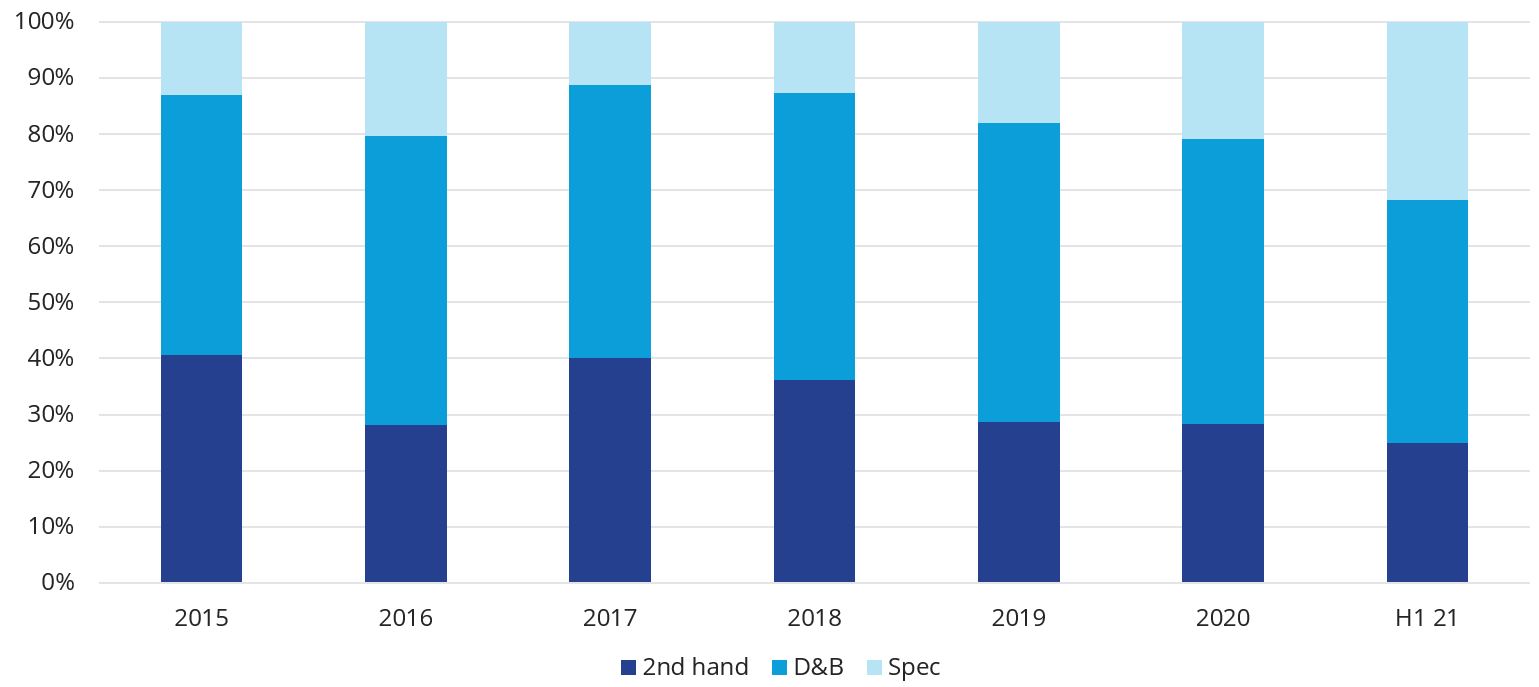

- Occupiers have been expanding and in some instances consolidating their operations in more efficient warehouses. Similarly to what’s been witnessed over the past 18 months, the first half of the year was marked by a flight to prime with only 26% of take up being of second-hand stock as opposed to 40% for design and build space and 34% being speculative development. New take-up has accounted for 74% of total take-up in H1 2021.

- Investors and developers are seeing strong rental growth which continues to drive inflationary pressure on development land values, with values for consented land nearly doubling over the past three to five years. This is making it very challenging for occupiers seeking either to lease new speculative warehouses or work with developers on a design and build basis.

UK take-up (m sq ft)

Source: Colliers - Note: Occupier deals 100,000+ sq ft

Take-up by type of unit (Share of total)

Source: Colliers

"Tenant demand has accelerated in Q2 and the creation of new supply can’t keep up, prompting further rental growth."

Len Rosso

Head of Industrial & Logistics, Colliers

Supply

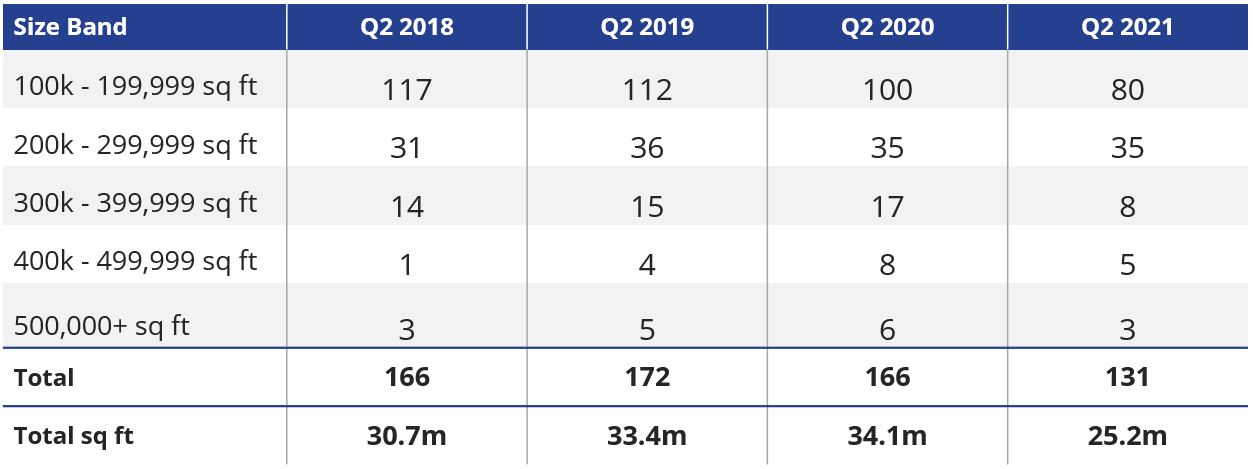

Given the extraordinary demand that we have witnessed over the past 18 months, Q2 supply is down 26% year-on-year to stand at 25.2 million sq ft. Despite these figures, which include speculative warehouse space due for practical completion by the end of Q3, the market currently exhibits the lowest level of availability on record. This equates to a vacancy rate of 4.3%. When analysing supply by number of unit and size band, only three warehouses over 500,000 sq ft are available (compared to six in Q2 20), and 80 assets in the 100-199,000 sq ft bracket on the market (compared to 100 in Q2 20).

Number of units available by size band and total supply

Source: Colliers - Note: Includes spec schemes with pc due in Q3 21

The good news is that investors and developers are building, and there are just shy of 60 planned deliveries of units over 100,000 sq ft from Q4 21 through to 2022. Not only will this ease the current situation but will also provide much needed space for the future as we expect the strong occupier demand to persist for at least the entirety of 2022 as occupiers continue to optimise their logistics networks. According to developers announcements, 2021 will see a total of 10.9m sq ft of new supply, however circa 45% of this space is either been pre-let or is under offer.

"Investor activity continues unabated and we expect yields to harden further over the next eight to 12 months before stabilising."

ANDREA FERRANTI

Associate Director, Research, Colliers

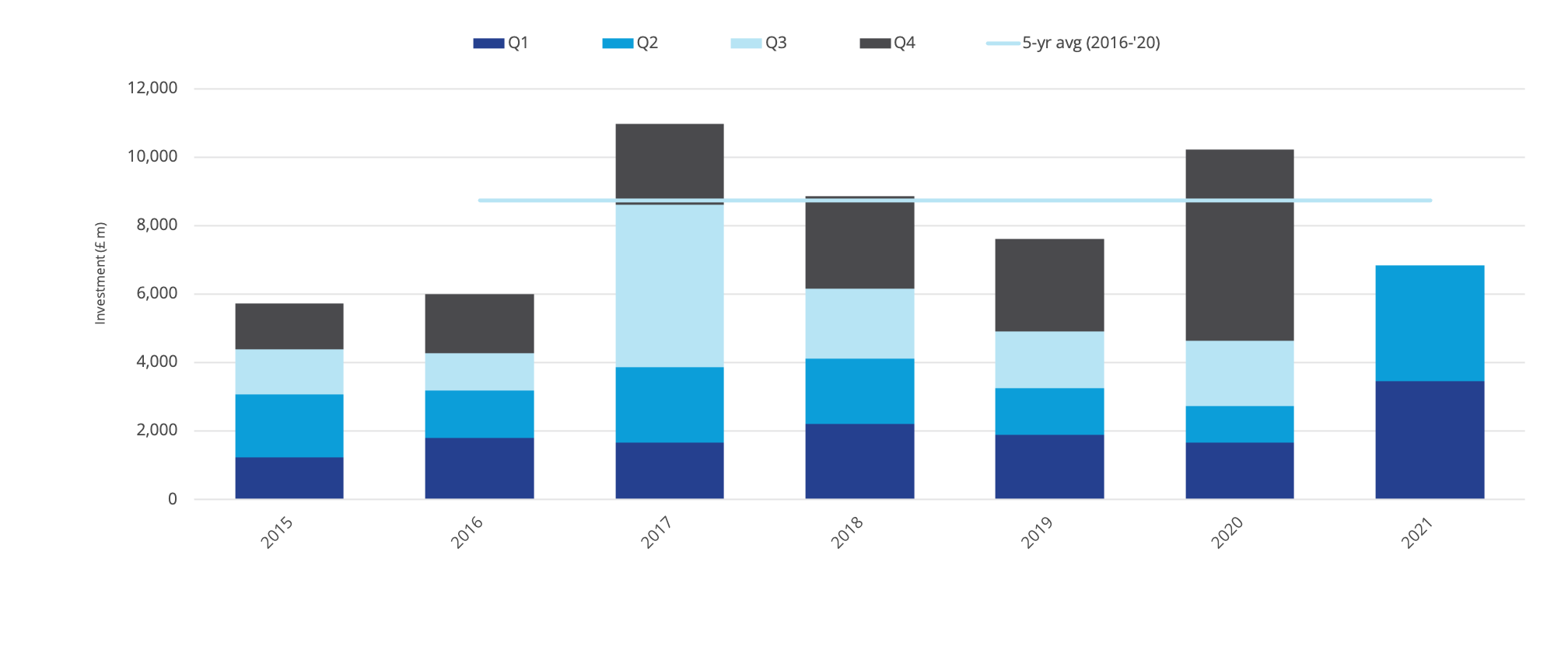

Investment activity across standard industrial and distribution warehouse assets in 2021 has continued where it left off at the end of last year. Provisional figures for H1 2021 saw circa £7bn invested in the sector, a new six monthly record for H1. We expect this figure to approach, if not surpass the £7.5bn mark as more transactions are validated.

In terms of investor activity, overseas buyers accounted for nearly half of the total transacted over the first six months of the year. North America headquartered investors led the pack with Blackstone remaining extremely acquisitive as highlighted by the purchase of the Albion Portfolio from Westbrook for £282.5m at a net initial yield (NIY) of 5.95% and the acquisition of the InfraRed’s Vantage portfolio for £186.5m at a NIY of 5.02%. Similarly, BentalGreenOak acquired seven logistics assets, totalling 2.18m sq ft from Morgan Stanley Real Estate for £303m at a NIY of 5.5%.

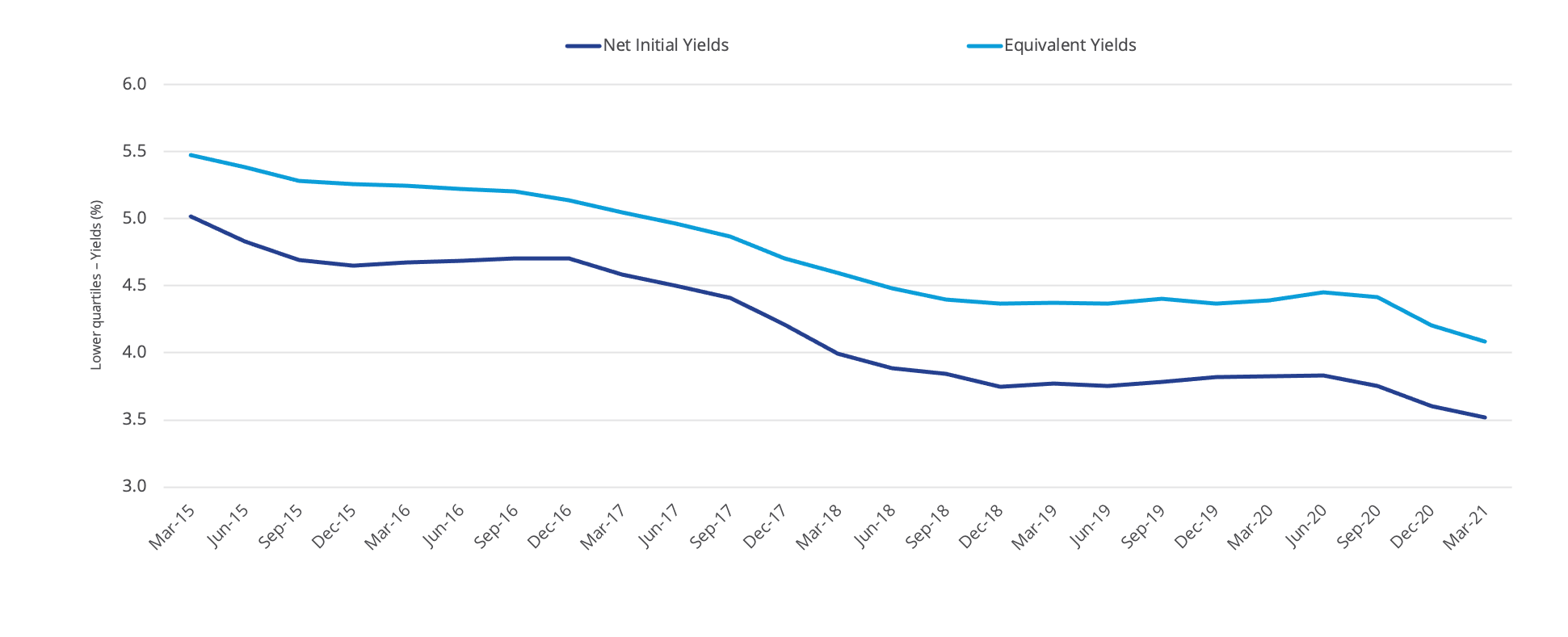

This strong buyer appetite continues to fuel further yields compression nationally. The latest quarterly MSCI data for Q1 2021, shows the lower MSCI quartile national net initial yield and equivalent yield at 3.6% (-9 bps q/q) and 4.1% (-12 bps q/q), respectively. We expect further yield compression over the next eight to 12 months due to accommodative monetary policy and strong buyer competition chasing limited opportunities.

UK industrial investment volumes (£m)

Source: Property Data, Colliers

Industrial yields – Lower quartile analysis (%)

Source: MSCI

Click here to learn more about our Industrial & Logistics services, latest research, videos and events

Copyright Colliers 2021 | Privacy Policy | Terms of use